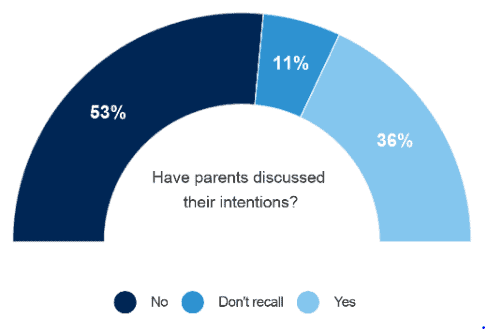

New research reveals over half of Australians (56%) do not currently have a will in place and more than half of parents (53%) have not discussed their will and legacy with their children, despite the nation gearing up to face the largest intergenerational wealth transfer in history.

Perpetual recently surveyed 3,000 Australians to find out their attitudes towards wealth, inheritance and their families. The 2019 edition of the ‘What do you care about’ research uncovered Australians hoped their children would use their inheritance wisely (60%) and invest in their future (58%).

Perpetual recently surveyed 3,000 Australians to find out their attitudes towards wealth, inheritance and their families. The 2019 edition of the ‘What do you care about’ research uncovered Australians hoped their children would use their inheritance wisely (60%) and invest in their future (58%).

Rising costs of living, slow wage growth and a volatile property market paint a very different picture of wealth for Australians today than it did 20-30 years ago and makes the smooth transfer of wealth even more important for the next generation of Australians.

It is estimated 70% of families will lose their wealth by the second generation and 90% will lose it by the third. To offset these risks, it is important the stigmas around discussing wills and inheritance are broken down so that all parties can be prepared and can have a plan in place.

“Conversations about money can be awkward, and for many, discussing where and how your wealth will be distributed when you’re gone is no exception,” said Perpetual Private’s Andrew Baker, General Manager of Private Clients.

“As humans, we tend to shy away from discussing money amongst our families and friends. However, as we approach the largest intergenerational wealth transfer in history with more than half of Australians expecting to inherit, why have only just over a third discussed their wishes with their children?”

‘Free Range Families’ most open to talking about money

The research also uncovered a unique cohort coined the ‘Free Range Families’, a group which values their families and interpersonal relationships over their financial situation. However, the research did reveal ‘Free Range Families’ are more comfortable talking about money, with 79% of ‘Free Range Families’ stating they are comfortable discussing money with their families, compared to 57% of Australians. ‘Free Range Families’ are also more comfortable discussing the future (82%), compared to Australians (57%).

With 59% of ‘Free Range Families’ in their fifties and above, they represent 14% of the total percentage surveyed. 64% of ‘Free Range Families’ are women, compared to 36% being men.

The report found attitudes to money are passed down through generations, with 62% of Australians and 69% of ‘Free Range Families’ stating their parents had some degree of influence towards their attitudes to money. When asked if they wished their parents had given them more help understanding financial matters, 32% of Australians said yes compared to 24% of ‘Free Range Families’.

Mr Baker urged families to normalise discussions around money and the future sooner rather than later in order to preserve wealth across generations.

“Baby boomers were fortunate enough to experience a period of supercharged wealth accumulation which has resulted in a stark contrast in levels of wealth between their generation compared to millennials and a contrast in attitudes towards money.

“When it comes to wealth, what’s important to you may not necessarily be important to your children but discussing your wishes openly will minimise any possible surprises or misunderstandings when it comes time to distribute inheritance.

“As your life changes, it is important to continually review and adjust your will in the instance you go through a major life event.

Financial education for following generations is essential. If you don’t know where to start, having a conversation with us here at Calibre Private Wealth Advisers can be a good step in the right direction. We have many years of practical experience in helping families with their intergenerational wealth advice needs. We can help work out a plan to discuss inheritance with your family, take control of your finances and give you peace of mind. The coming holiday season might be a great time to talk about some of these matters with your family.

If you have any questions/thoughts in relation to this article or would like more information, please click here to send us a brief email.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.