Investment returns for Australians with a financial adviser are 5.9 per cent better off than non-advised investors, according to research from investment manager Russell Investments.

The 2023 ‘Value of an Adviser Report’ report calculated this value by examining the five components of advice delivery, citing specific values to three components: behavioural coaching (3.4 per cent); suitable asset allocation (1.2 per cent); tax-smart planning; and investing (1.3 per cent). Additionally, it found “choices and trade-offs” and the “expertise gained over an adviser’s years in the profession”, as having a “variable” and “priceless” impact, respectively.

“This [5.9 per cent] is substantially higher than the typical adviser fee paid by clients and a validation of the holistic service that advisers provide to clients,” the report said.

“It is a function of their ability to help clients adapt as markets, regulations, and their own circumstances change.”

Articulating the 1.2 per cent value add from suitable asset allocation, the report said asset allocation determines 85 per cent of the outcome for an individual ahead of the selection of the actual assets within a portfolio.

“It is also, though, perhaps the most underestimated element of financial advice by the general public,” the report said.

“Retail investors are more inclined to remember the returns of individual stocks – such as this year’s gains from the so-called magnificent seven AI stocks – than how asset allocation laid the foundation for overall risk-adjusted returns.”

For behavioural coaching – which added 3.4 per cent – the report identified the benefits a properly constructed portfolio can have during periods of volatility, citing the recent Covid-19 pandemic and the war in Ukraine.

“Without the guidance of advisers, investors can fall into the trap of buying when markets are bullish and selling when sentiment turns bearish,” the report said.

“There is real value in the ability of advisers to help clients maintain their long-term strategies in the face of unnerving volatility.”

For the 1.3 per cent value added from tax planning, the report found tax knowledge is as much part of an adviser’s role as a grasp of markets or estate planning.

“In fact, the importance of tax know-how becomes more critical every year,” the report said.

“This is perhaps most obvious in superannuation due to the continued introduction of caps designed to limit the amount of capital that people can hold in tax-effective retirement funds. Also, due primarily to these super cap limits, it is becoming equally important understanding the strategic options for growing and managing wealth outside superannuation.”

The report also shows a client’s wealth journey also extends beyond the quantifiable value provided by their adviser – highlighting the important role advisers provide as financial coaches, helping to manage client behaviour and providing emotional expertise.

Adviser role helping with choices and trade-offs

The role of advisers as financial coaches whose work extends beyond the selection of investments to holistic wealth management is not always understood. However, the growing complexity of regulation, family situations and social security means it is increasingly invaluable.

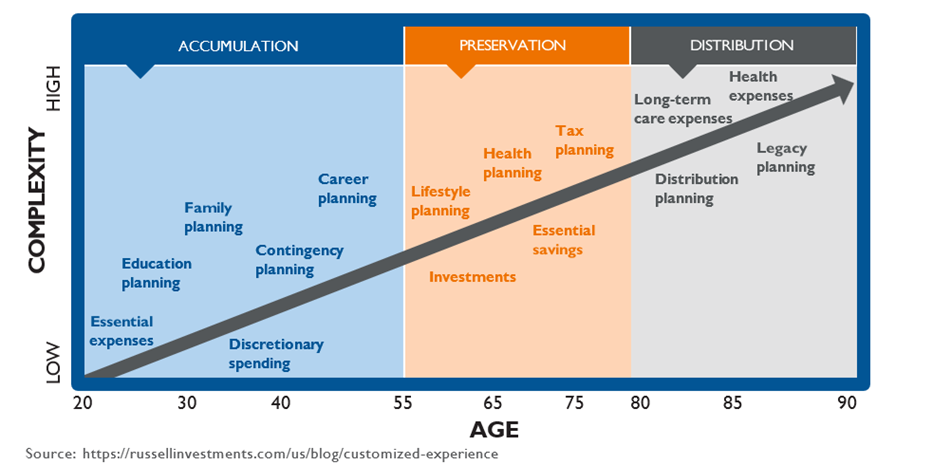

The inputs into this advice changes as clients age and go through typical life stages, from early adulthood when they are accumulating assets to late middle age when other considerations come into play and, finally to older age when their affairs take on an added dimension.

More people will fall into the latter category over next 40 years, with the 2023 Intergenerational Report forecasting the number of Australians aged 65 and over will more than double. Those aged at least 85 are forecast to more than triple and the number of centenarians is expected to increase six-fold.

All this means the financial affairs of a broad cross section of the community encompass many choices and trade-offs that previous generations didn’t always face. For example:

The so-called “bank of mum and dad” has grown rapidly as adult children ask parents to fund mortgage deposits.

Grandparents are more often funding school fees as the cost of private education extends beyond the reach of parents.

Second marriages can add an extra layer to estate planning, particularly to provide for two sets of children.

The so-called sandwich generation must juggle the financial and emotional needs of ageing parents with those of their own children.

Older parents are sometimes asked to provide an early inheritance to adult children or grandchildren to supplement their income.

Older singles have a broader range of retirement funding options to consider, including downsizer contributions to superannuation.

Good advisers are more than just financial technicians

Advisers are more than financial technicians. They are also specialists in human behaviour who build trusted relationships with clients that allow them to deliver on their recommendations.

In the best of times, advisers help clients achieve life-long goals and celebrate personal milestones along the way. But they also support people in challenging times – through trauma, illness, financial crises, job loss and death.

The unique combination of technical skill and emotional expertise demonstrated by advisers provides a priceless form of value to their clients.

In terms of technical expertise, regulatory change and product innovation are constants in the Australian financial system. Advisers are at the front line of interpreting change to determine both the impact and, of course, opportunities for clients.

This is a real responsibility due to the level of financial literacy among Australians. A 2021 survey conducted as part of the federal government’s Financial Capability Strategy found Australians scored 68 out of 100 in terms of financial literacy. There is an obvious need for improvement and advisers can help bridge the gap.

We are here to help

Calibre Private Wealth Advisers provides financial leadership and peace of mind for successful professionals, business owners and their families.

We engage our clients in real conversations around their life and then help them use the money they have to get the best Return on Life

If you have any questions/thoughts in relation to this article or have a need for some advice and would like to discuss your particular situation, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.