For many years, superannuation has provided significant tax benefits for retirees. However, recent changes in legislation limit the amount that can be placed into super, and investment returns may not be as good as in the past. As a result, future generations are likely to pay more tax in retirement as they will hold more of their wealth outside super.

For many years, superannuation has provided significant tax benefits for retirees. However, recent changes in legislation limit the amount that can be placed into super, and investment returns may not be as good as in the past. As a result, future generations are likely to pay more tax in retirement as they will hold more of their wealth outside super.

This problem can only be minimised with long-term planning.

What is the problem the next generation is likely to face?

- Future generations may not able to accumulate adequate funds into superannuation because:

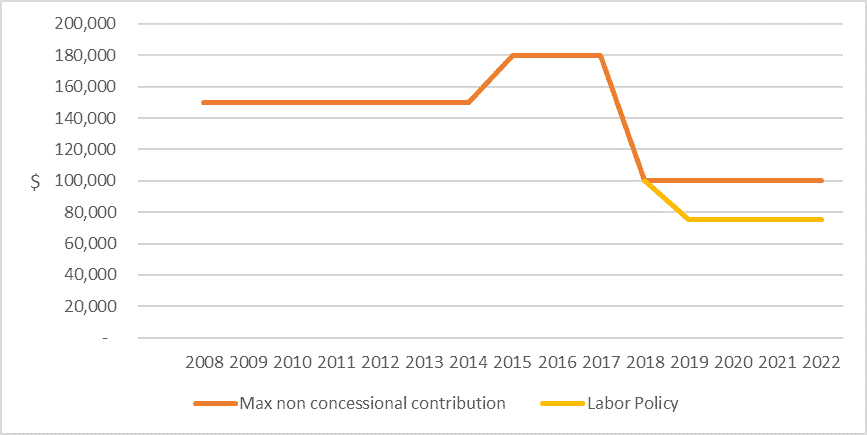

On average, mortgages are higher and take longer to pay off. Understandably superannuation is often not the main financial priority for many people until well into their 50s. - There has been a progressive reduction in the amount that individuals can contribute to super. The graph below shows how the maximum annual non-concessional (after-tax) contribution has fallen in recent years (and to zero if the $1.6 million Total Superannuation Balance (TSB) has been reached).

- It is Labor policy to reduce the annual non concessional contribution amount to $75,000. These rules will further disadvantage individuals who obtain wealth later in life.

- A steady increase in life expectancy means that many children will not receive an inheritance until they are in their 60’s. Given that an individual cannot contribute to super after the age of 64 unless they are working, this will give little time to make more contributions.

So, while the $1.6 million TSB may be a concern of many retirees of the current generation, it will not be a concern for the next as many will not get even close to this level.

Helping a child make a concessional (tax-deductible) contribution

There are many different views on whether parents who have excess money available to help their children should do so – this is a very personal family decision. If the parents decide they would like to help their children in this way, the children’s tax position needs to be considered and as such, superannuation should be a factor.

The major benefit received from making tax deductible superannuation contributions is the compounding effect of paying a lower tax rate. This can be shown by a simple example.

Bryce is 40 years old and earns $100,000 a year. His employer contributes the minimum required superannuation guarantee (SGC) of 9.5% or $9,500. Including the SGC, he is entitled to make a deductible contribution of $25,000 but does not have the financial resources to use his full limit.

He expects to retire at age 65. His mother would like to help Bryce build some wealth in a tax-effective way. Note that:

- Bryce’s marginal tax rate is 39%

- Contributions to super are taxed at 15%

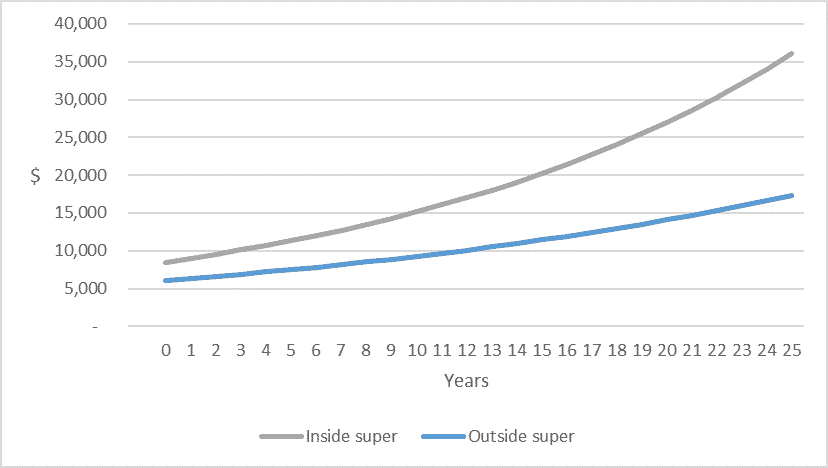

So, there is a 24% tax saving by Bryce’s mother adding funds to his super. As shown in the graph below, the long-term effect of this tax saving is substantial. Assuming future earnings are taxed at 15% inside super, compared to 39% outside and the investment return is 7%, the net value of this $10,000 will be worth over double if held inside super compared with outside. Bryce will also have a lot more money in his super at 65 resulting in a more tax-effective retirement.

Helping a child to make non-concessional (after-tax) contributions

Given that there is no initial tax deduction, lending money to a child to make a non-concessional contribution is not as beneficial in the short term. However, in our experience, it is still worth considering by individuals or families with significant wealth. For example, an individual who is Age 75 with children who are Age 50 may take the opportunity to add to their child’s super progressively knowing that they may otherwise be left with considerable funds outside superannuation when they receive an inheritance.

Conclusion

It is becoming increasingly difficult to maximise the benefits of superannuation. More thought needs to be put into not only how much wealth is transferred to the next generation but also how it is transferred.

A strategy like this may have significant tax, family and estate planning consequences. As a result, it should not be entered into without first receiving both financial and legal advice.

If you have any questions/thoughts in relation to this article or would like more information, please click here to send us a brief email.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.