Asking the right questions and following a few key principles will help you adhere to your long-term investment plan and significantly improve your odds of long-term investment success.

Whether you’ve been investing for decades or are just getting started, at some point on your investment journey you’ll likely ask yourself some of the questions below. Trying to answer these questions may be intimidating but know that you’re not alone – we are here to help. While this is not intended to be an exhaustive list, it will hopefully shed light on a few key principles, using data and reasoning, that may help improve investors’ odds of investment success in the long run.

1. What sort of competition do I face as an investor?

The market is an effective information-processing machine. Millions of market participants buy and sell securities every day, and the real-time information they bring helps set prices. This means competition is stiff and trying to outguess market prices is difficult for anyone, even professional money managers (see question 2 for more on this). This is good news for investors though. Rather than basing an investment strategy on trying to find securities that are priced “incorrectly,” investors can instead rely on the information in market prices to help build their portfolios (see question 5 for more on this).

Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

2. What are my chances of picking an investment fund that survives and outperforms?

Flip a coin and your odds of getting heads or tails are 50/50. Historically, the odds of selecting an investment fund that was still around 15 years later are about the same. Regarding outperformance, the odds are even worse. The market’s pricing power works against investment managers who try to outperform through stock picking or market timing. As evidence, only 13% of Australian large cap equity funds outperformed their benchmark over the past year and only 17% outperformed over the past 10 years. The same applies globally- only 30% of funds outperformed their benchmark over the past year and only 10% outperformed over the past 10 years

Source: S&P Dow Jones SPIVA Australia Scorecard Year End 2018.

3. If I choose an investment fund because of strong past performance, does that mean it will do well in the future?

Some investors select mutual funds based on past returns. However, research shows that most investment funds in the top quartile (25%) of previous three-year returns did not maintain a top-quartile ranking in the following three years. In other words, past performance offers little insight into an investment fund’s future returns.

Source: Mutual Funds Landscape 2018, Dimensional Fund Advisors. The funds referred to are US mutual funds which are not registered as managed investment schemes with the Australian Securities and Investments Commission and as such these funds are not currently available to Australian investors.

4. Do I have to outsmart the market to be a successful investor?

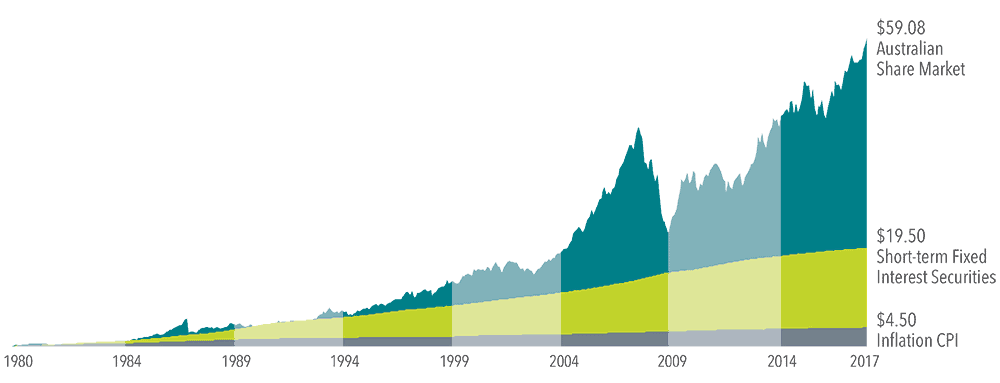

Financial markets have rewarded long-term investors. People expect a positive return on the capital they invest, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. Instead of fighting markets, let them work for you.

Growth of a Dollar

1980-2017 (compounded monthly)

In Australian dollars. Australian Share Market: S&P/ASX 300 Index (Total Return), Short-term Fixed Interest Securities: Bloomberg AusBond Bank Bill Index and Inflation CPI: Australian Consumer Price Index. S&P/ASX data © 2018 S&P Dow Jones Indices LLC a division of S&P Global. All rights reserved. Data provided by Bloomberg Finance LP. Australian Consumer Price Index provided by Australian Bureau of Statistics.

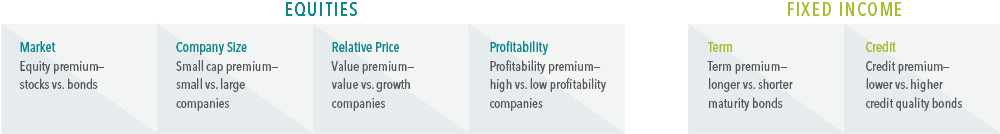

5. Is there a better way to build a portfolio?

Academic research has identified these equity and fixed income dimensions, which point to differences in expected returns among securities. Instead of attempting to outguess market prices, investors can instead pursue higher expected returns by structuring their portfolio around these dimensions.

Relative price is measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and amortisation minus interest expense scaled by book.

6. Is international investing for me?

Diversification helps reduce risks that have no expected return but diversifying only within your home market may not be enough. Instead, global diversification can broaden your investment opportunity set. By holding a globally diversified portfolio, investors are well positioned to seek returns wherever they occur.

Data as at 31 December 2017. Number of holdings and countries for the S&P/ASX 300 Index and MSCI ACWI (All Country World Index) Investable Market Index (IMI) as at 31 December 2017. S&P/ASX data © 2018 S&P Dow Jones Indices LLC, a division of S&P Global.

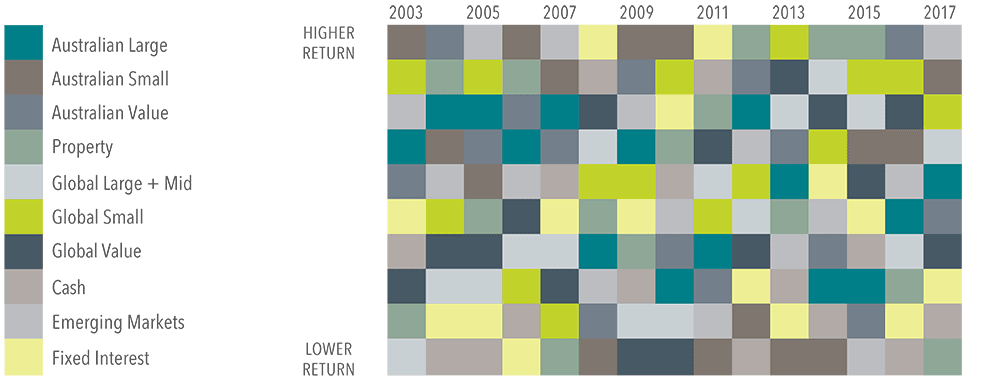

7. Will making frequent changes to my portfolio help me achieve investment success?

It’s tough, if not impossible, to know which market segments will outperform from period to period.

Accordingly, it’s better to avoid market timing calls and other unnecessary changes that can be costly. Allowing emotions or opinions about short-term market conditions to impact long-term investment decisions can lead to disappointing results.

Annual Returns by Market Index

In Australian dollars. Data is the annual return to 31 December 2017. Data used for each asset class is as follows: Australian Large: S&P/ASX100 Index (Total Return), Australian Small: S&P/ASX Small Ordinaries Index (Total Return), Australian Value: S&P Australia BMI Value Index (gross dividends), Property: S&P Global REIT Index (gross dividends), Global Large + Mid: MSCI World Index, (gross dividends), Global Small: MSCI World Small Cap Index (gross dividends), Global Value: MSCI World Value Index (gross dividends), Cash: Bloomberg AusBond Bank Bill Index, Emerging Markets: MSCI Emerging Markets Index (gross dividends), Fixed Interest: Bloomberg Barclays Global Aggregate Bond Index (hedged to AUD).

8. Should I make changes to my portfolio based on what I’m hearing in the news?

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. If headlines are unsettling, consider the source and try to maintain a long-term perspective.

9. So, what should I be doing?

Work closely with a financial adviser like Calibre Private Wealth Advisers who can offer expertise and guidance to help you focus on actions that add value. Focusing on what you can control can lead to a better investment experience.

- Create an investment plan to fit your needs and risk tolerance.

- Structure a portfolio along the dimensions of expected returns.

- Diversify globally.

- Minimise expenses, turnover, and taxes.

- Stay disciplined through market dips and swings.

10. Our approach to managing your money

We help our clients by building investment solutions that pursue higher expected returns in a systematic way

- Firstly, we apply stringent academic research from some of the finest investment minds in the world to identify sources and dimensions of higher expected returns

- We then design portfolios to systematically capture those sources of higher expected returns

- Finally, we construct and maintain portfolios that are low cost, tax efficient and highly diversified whilst avoiding unnecessary turnover and trading costs

History has shown this to be the best way to protect and grow your wealth, so you have the highest chance of achieving your goals.

Got any questions? Please click here to send us a brief email.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.