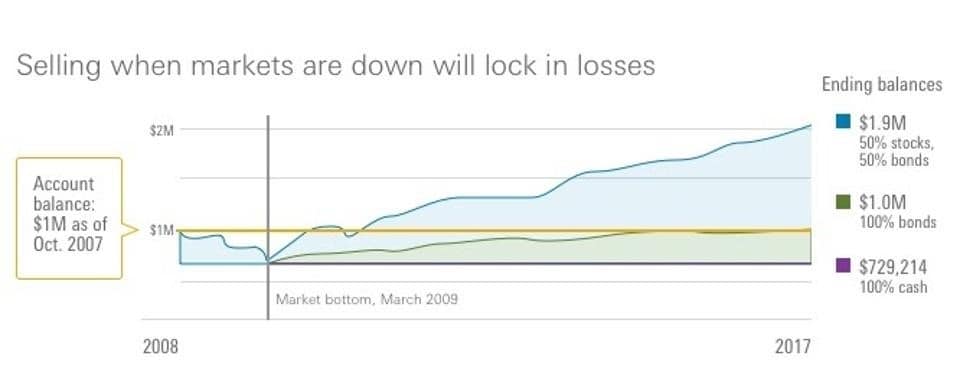

As humans it’s normal to feel anxious, worried or even fearful during times like these when markets are highly volatile or losing value. What causes the problem is acting on those emotions and doing something irrational (and detrimental) to your longer-term financial health. To help illustrate this point, Vanguard have created a useful chart to show what happened to 3 investors who found themselves at the bottom of one of the worst bear markets in history: The Global Financial Crisis.

From 2008 to 2009, even balanced portfolios lost almost 30% of value. It was, to say the least, a stressful time to have money in the market.

Each of the investors chose a different course of action:

- Investor 1, represented by the blue line in the chart below, decided to stick with her plan. She started with a 50% Growth/50% Defensive allocation and didn’t sell out of the equities portion.

- Investor 2 couldn’t stand the pain of loss anymore. Although he initially had the same 50/50 portfolio allocation, he decided to sell all his equities to buy into bonds. He sold all of his stocks to buy bonds, feeling this was “safer.”

- Investor 3 felt she had to protect the money she had left, and she sold everything to move to cash.

So how did the investors end up?

- Investor 1— who stayed put and stuck to her plan — regained all the lost value in her portfolio by mid 2010. By 2017, her portfolio balance was almost double the other two investors who panicked and couldn’t stick with their investment strategy.

- It took Investor 2 almost 8 years just to regain the lost value in his portfolio. And he’s far behind Investor 1, who stayed invested according to her plan.

- And Investor 3, who moved to cash to protect her money? Not only did she never make her money back, but she’s also the only one of the investors in this scenario who ended up with a realised loss.

What this shows us is that the investors who panicked and sold equities at the bottom of the market would have taken years to break even… or they would have realised their losses and locked them in, to wind up with far less money than they would have had they done nothing and simply stayed the course.

Next steps

To find out more about how any of these measures may be of assistance in your individual circumstances, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.