In early-2015 investment blogger Ben Carlsen wrote a piece called The Psychology of Sitting in Cash where he tried to answer the following reader question:

I took one piece of advice from a close friend that the market was too high and that I should go to cash and wait for a correction. I am still waiting. How do I proceed from the position I have of feet embedded in concrete?

He never did hear back from this reader to see how they handled this situation.

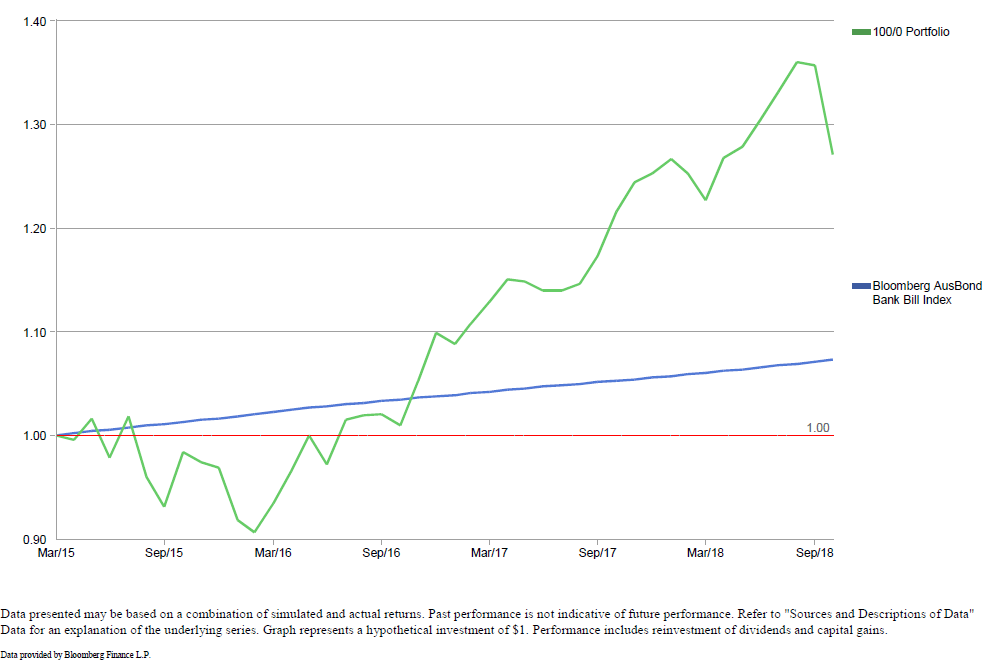

Since then there have been opportunities to put money to work at lower levels in this time. In early 2015, a 100% growth focused portfolio with a mix of Aust and International Shares fell around 9% in local currency terms. Then in early-2016, it fell more than 18% over a few months. Earlier this year this type of growth portfolio fell around 10% from previous highs and is currently down around 10% from Sept 2018 highs.

But if they didn’t take advantage of those corrections and are still sitting in cash, things have become even more painful. Even after the latest bout of selling, a 100% Growth portfolio is still up around 28% in total since Ben wrote that piece.

Professional investors like to talk about how holding cash gives them optionality and the ability to potentially buy assets at super cheap prices. That may be the case, but when you consistently hold a large majority of your entire portfolio in cash all it does is add pressure to the timing of your buy and sell decisions.

Here are a few considerations for those who are sitting on a big pile of cash or are thinking about raising cash now that we’re in the midst of another correction:

Corrections & bear markets don’t make it any easier to pull the trigger

You would assume it becomes easier to buy stocks when they’re falling but cash is a comfortable place to be during a correction. It’s like you’re tucked in under your warm doona on a freezing Saturday morning in the winter and you never want to get out of bed.

When stocks begin to fall that comfort can lead to a cash addiction where you keep telling yourself you’ll buy when the market falls a little further or the dust settles. And each time they fall you move that hurdle to buy just a little higher until you’re never able to pull the trigger.

Waiting is the hardest part

Let’s say that after the very strong couple of years of share market returns in the 2 years period up to early 2015, you either sold out of your growth portfolio or elected to keep the existing cash you had rather than invest it in the markets at that point. As the chart below shows, with the benefit of hindsight these calls would have saved investors from some short-term pain in the immediate period that followed, but since been since March 2015 a 100% Growth portfolio (green line) is still up around 28% in value including the current market correction. This compares to a cumulative return of around 8% by having your funds deposited in cash (blue line) over the same period. Just to get back to those levels where you got out or chose not to invest, your growth portfolio would have to drop another approx. 18% from current levels. Waiting for this type of pullback can wreak havoc on your psyche when it doesn’t come right away.

Cumulative Return of a 100% Growth Portfolio versus Cash.

Drop the anchor

Continuing with this same example, let’s say you did sell out and plan to wait so you can break even on this timing trade. Making your buy decision strictly based on when you sold will likely only compound the issue. Make your investment decisions based on the present, and more importantly the future, not the past. Anchoring to previous market levels is a good way to compound previous mistakes.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.