A key to a successful investment experience is understanding how markets behave and developing the discipline to avoid rash decisions based on short time periods. The recent performance of the Australia and New Zealand share markets drives this home.

There was a distinctly gloomy tone to media commentary in late 2018. The Australian market had closed out its worst year since 2011, falling 3%. While the New Zealand market rose by a little under 5% over the year, it was still its weakest performance in seven years.

What did most of the damage was a rough final quarter. Developed markets fell around 11% amid media headlines focusing on US−China trade tensions, continuing uncertainty over Brexit, slowing global economic growth and earnings warnings.

The picture so far in 2019 is in stark contrast. The Australian market was up by a little over 10% in the first two months, while the New Zealand market had gained just under 6%. The global equity market, as measured by the MSCI World index, was up by just under 10%.

Interestingly, many of the headlines remain the same— trade tensions (albeit with prospects of a deal), Brexit, slowing growth and earnings uncertainty. This is a reminder that market participants are continually absorbing information and calibrating their collective expectations. As market prices are always forward looking, they continuously reflect these changes in information and expectations.

Highlighting how quickly markets can change is the fact that while the 6% fall in Australia’s benchmark S&P/ASX 300 index last October was its sixth worst monthly performance in 10 years, its 6% gain in February was its eighth best in the same period.

The virtue of taking the rough with the smooth can be seen in the difference that can result from just waiting out a month or two of difficult markets.

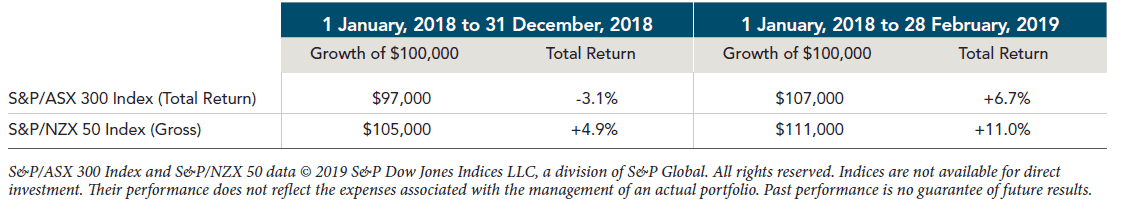

The table below shows the total return in local currency and growth of wealth for $100,000 invested in the Australian and New Zealand share markets, measured from the beginning of 2018 to both the end of 2018 and to the end of February 2019.

Notice the difference that a couple of good months can make. In the Australian case, the investor who entered the market in January was underwater by the end of the year but was showing a near 7% gain just two months later.

Exhibit 1: The Virtue of Discipline

The lesson is that while shares have historically generated higher returns than cash, their performance over shorter periods can differ considerably from long−term returns.

For instance, the long−term return of Australian shares going all the way back to 1980 is about 11% per annum. But this can mask a wide dispersion in outcomes over any one year. Indeed, there have been one−year losses of 20% or more and gains of 20% or above in the 11 calendar years since then.

On a month−to−month basis, the ups and downs are even more pronounced. As an example, the Australian market has fallen by as much as 40% in one month (the Black Monday crash of October 1987) and risen by more than 17% (in January 1980).

Performances of various asset classes from month−to−month and year−to−year are also unpredictable. For New Zealand investors, for example, Kiwi shares were a relative winner in 2018. But in 2017, it was emerging markets, while in 2011, it was fixed interest. For Australian investors, listed property was the best performer in 2018.

The year before it was emerging markets. And back in 2011, it was fixed interest.

Of course, most gains and losses month to month are nowhere near as dramatic as in those instances. But the bumpy ride that shares sometimes provide over the short term is the price we pay for the chance to earn the returns on offer over the long term. Being informed about the volatility of market returns helps you embrace this uncertainty, ignore the constantly changing headlines and stay invested.

By the way, you can reduce the bumpiness of that ride by expanding your investment opportunity set and diversifying across different markets and asset classes.

Conclusion

What will be the best investment in 2019? No−one knows. You can guess, but that’s an approach to investment that really comes down to luck. The alternative is building a mix of assets tailored to your goals and risk appetites, diversifying as broadly as possible and learning to take the rough with the smooth.

At Calibre Private Wealth Advisers, we know from experience and knowledge that it is not necessary to accurately predict the future to have a successful long-term investment experience. Our evidence-based investment approach integrates stringent academic research, portfolio design and ongoing portfolio management with the goal of delivering an outstanding investment experience to every client.

Over the long term we have achieved consistently strong results for our clients whilst using strategies to protect client portfolios against volatile markets.

Got any questions? Please click here to send us a brief email.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.