Ask a farmer about average rainfall figures and he’s likely to look at you sceptically. Knowing how actual rainfall varies from year to year, farmers will carefully manage their crops and irrigation. It’s a lesson many investors could learn as well.

Staying disciplined when markets are volatile is easier once you accept that references to “average” annual returns, like rainfall, can mask a wide range of possible outcomes.

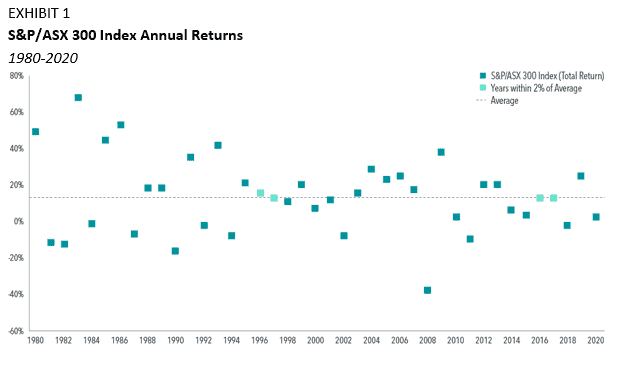

For instance, from 1980 to 2020 the Australian share market delivered an average annual return of nearly 13%. But in only four years over that four–decade period have actual returns been within two percentage points either side of that average.

In those 41 years, the local market has fallen in 11 calendar years and gained in 30 years, or more than 70% of the time.

The biggest one–year fall was during the global financial crisis of 2008, when the S&P/ASX 300 index fell nearly 40% on a total return basis. The biggest one–year gain was in 1983, when the market rose nearly 70%.

Exhibit 1 shows that only in four years—1996, 1997, 2016 and 2017—has the local market’s annual movement been between two percentage points either side of the four–decade average annualised return of 12.93%.

Dealing with volatility is part of the price investors pay for the returns on offer from equity markets. Those returns are unpredictable from year to year, making it near impossible to time the market. This means the most reliable way of securing the long–term average returns on offer is staying in your seat.

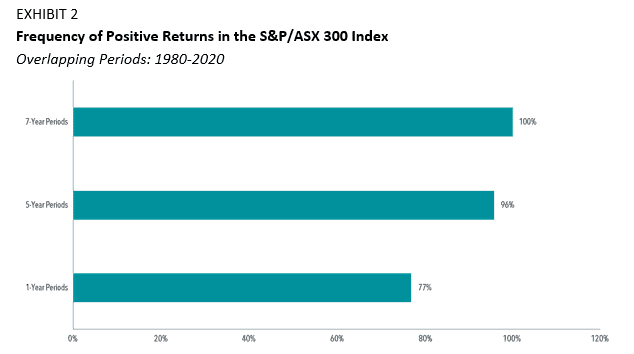

The benefits of a long–term focus can be seen in Exhibit 2. This shows you the historical frequency of positive returns from Australian shares over different rolling periods.

This is a way of comparing returns for overlapping holding periods, starting from different dates. So, in this case, the first period starts in January 1980, the second in February 1980 and so on. In this case, we are projecting one year, five years and seven years forward from each starting point.

The chart shows you that one–year returns on a rolling basis were positive 77% of the time in our sample period from 1980 to 2020. This increased to 96% over five–year periods and 100% over seven–year periods. (By the way, just because the seven–year rolling period performance in this relatively short sample has always been positive doesn’t mean it will always be so. In the US, for instance, where we have data going back to the 1920s, there have been longer periods when there was no market premium.)

What this all means is that just being aware of the range of potential outcomes in markets year to year can help you remain disciplined, which in the long term can increase the odds of having a successful investment experience.

Aside from discipline, another way of dealing with volatility is diversification. Just as farmers deal with variable rainfall by planting different types of crops, investors can manage volatility by spreading their bets.

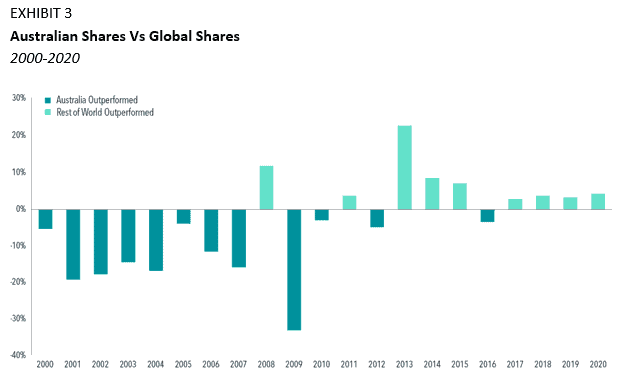

Exhibit 3 compares the return of Australian shares over the rest of the world from 2000 to 2020. The result is the gap between the two. A negative number means Australia outperformed the rest of the world. A positive means the rest of the world beat Australia.

So, you can see that Australia did very well in the early years of the millennium, compared to other markets. You may recall this was the time of the China–led resource boom. More recently, Australia has lagged other markets.

The point of this is to show that you can lessen your reliance on the year–to–year performance of the Australian market (which after all only makes up about 2% of the world market) by spreading your investments to include international markets.

Diversification is a way of reducing the bumpiness of returns and of increasing the reliability of outcomes. This way you become less exposed to one market or one or two dominant sectors, which in Australia’s case currently are resources and banks.

In summary, the notion of “average” returns can be misleading. It’s wise to understand and be prepared for the range of individual outcomes that makes up that average.

You can deal with the ups and downs in two ways. Firstly, by taking a long–term view and remaining disciplined, you are more likely to experience that average return. Secondly, you can diversify across countries so that you lessen the impact of big swings in any one market.

Of course, this still doesn’t guarantee there won’t be investment droughts, but this may make it easier for you to stick with your plan and reap the harvest in the end.

Next steps

To find out more about how any of these measures may be of assistance in your individual circumstances, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.