Selling is the easy part but what about reinvesting?

One of the bigger challenges facing investors is to hang on to their shares during a market selloff, or when the perception that the future for equities is bleak. Investors often justify the sale by telling themselves they will ‘buy back at a lower price’, but that will probably become a doomed attempt to make two correct timing decisions. It may mean the investor is out of the market and misses long-term gains.

The share market falls by 10% or more at some stage in most years and suffers negative returns in about three out of every 10 years. Substantial falls of over 30% occur every 20 years or so. There is never a shortage of reasons to sell, as shown below, and always an expert fund manager warning of doom. For retirees in particular, the threat of a significant loss of capital can be too much to bear, leading to selling even when shares are supposed to be part of a long-term portfolio holding.

Double trouble, both the sale and the repurchase decision

The right time to sell is difficult enough to time, and generally done at the wrong moment. Deciding to sell and then buy when the market might be somehow lower is even tougher, doubling the required timing luck. As Howard Marks said:

“In both economic forecasting and investment management, it’s worth noting that there’s usually someone who gets it exactly right … but it’s rarely the same person twice.”

Those who are reassured by the intention to buy back in as soon as things have ‘settled down’ face two major hurdles:

- If the market falls, the temptation is to wait longer for the bottom, as if someone rings a bell on the critical day. OR

- If the market rises, there is a psychological hurdle of paying more for the same shares that were recently sold at a lower price.

At least the decision to sell may be justified and driven supposedly by short-term risk mitigation, or a market event or changed outlook which justified caution. But what trigger does the investor look for to buy back in?

The impact of major falls such as in the GFC

The GFC was about 15 years ago but its impact has remained profound for many investors. Between November 2007 and March 2009, the S&P/ASX200 Accumulation Index fell 51%, and it was a shock for many.

The most unfortunate impact was that retirees experienced such a rapid loss in the value of their retirement savings that it turned them against equity investing. They not only missed the subsequent recovery, but the large fall drove a conservatism that misses the long-term benefits of equity market growth.

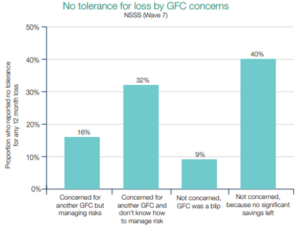

The most comprehensive survey of the reactions of older Australians to the GFC was conducted by National Seniors. Although Once Bitten Twice Shy was published five years ago in 2018, it shows the ongoing impact of a significant market fall. The survey concluded:

“Ten years on from the GFC, its impact lingers for most older Australians, who express a ‘once bitten twice shy’ sentiment as a result of their experiences. Seven out of 10 are still concerned about another potential market collapse. Older Australians are still wary of market turmoil, with only one in fourteen thought they would be able to tolerate a loss of 20% or higher – about the same as the fall in superannuation returns during the GFC a decade ago. One in four said they could tolerate losses greater than 10%, though the same proportion said they could not tolerate any annual loss on their portfolio.”

Relationship between having no tolerance for loss and GFC concerns (%)

Long-term consequences for investment returns

There are many studies which show that investors earn less than the funds they invest in. For example, Morningstar produces an annual Mind the Gap report, which concluded in 2023:

“Our annual study of dollar-weighted returns (also known as investor returns) finds investors earned about 6% per year on the average dollar they invested in managedl funds and exchange-traded funds over the trailing 10 years ended 31 December 2022. This is about 1.7% less than the total returns their fund investments generated over the same period. This shortfall, or gap, stems from poorly timed purchases and sales of fund shares, which cost investors roughly one fifth the return they would have earned if they had simply bought and held.”

Morningstar Australia’s Mark LaMonica examined the history of the report and the numbers have been similar for many years. He says:

“The larger point is that timing the market is hard. Expectations are baked into prices which means that once there is more clarity on the certainty of an outcome it is often too late. Timing the market means anticipating future events before other investors. It also means getting the call right. That can be a lonely and intellectually challenging exercise. Because everyone else is doing and saying the opposite. It is hard to go against the crowd.”

What’s the main lesson?

Many investors sell because they think the stockmarket will fall, with the intention of reinvesting. It requires two correct timing decisions but what signals will prompt a reinvestment? Decades of evidence shows it’s harder than it looks. Correct execution of two-timing decisions will be more a matter of luck than profound foresight.

The lesson we can derive from this is that when you take panic selling or emotional decisions out of the equation, investors tend to fair better.

Staying the course is not an easy feat. You are battling against primal emotions, and you are forcing yourself to make unnatural decisions.

As an investor, your most reliable tools are diversification, discipline and a financial adviser who knows you, your family and your aspirations, understands what you can live with and builds you a portfolio that is designed to cope with market volatility and maximise the chances of you reaching your goals.

We are here to help

Calibre Private Wealth Advisers provides financial leadership and peace of mind for successful professionals, business owners and their families.

We engage our clients in real conversations around their life and then help them use the money they have to get the best Return on Life

If you have any questions/thoughts in relation to this article or have a need for some advice and would like to discuss your particular situation, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.