Parents, if you had only had one concept to explain to your children to help them as they set out on their investment journey, it should be Compound Interest. It’s becomes even more relevant for saving when projected returns are expected to be lower.

Albert Einstein described compound interest as “the eighth wonder of the world”.

You can see why the quote is so popular. It’s the single most powerful concept to understand and experiment with to appreciate investing and long-term financial planning.

Here’s some analysis to prove the point

Table 1 below compounds returns over various periods using four real return assumptions (i.e. the return above inflation of 2.5%):

- 5% real (or 10% nominal), an extremely optimistic outlook similar to past returns from last few decades when interest rates were much higher

- 5% real, which is still optimistic with rates so low

- 5% real, perhaps from a moderate/balanced portfolio with reasonable exposure to growth assets

- 0% real or about 2.5% nominal, which is an optimistic assumption for anyone stuck in term deposits or cash.

The results from investing $100,000 at the start are as follows:

Let’s focus for a moment on the shaded 5% results (assumes interest compounded at 5%):

- At the end of five years, the $100,000 investment has grown to $127,628. The extra $2,628 over the simple interest of $25,000 is interest on interest (compound). Doesn’t sound like much.

- At the end of 10 years, the $100,000 investment has grown to $162,889. Now there is $12,889 added to the simple interest of $50,000. Both are periods of five years, the first one with an extra $2,628, the second 5 years with $12,889. This is compounding, interest on interest, kicking in.

- After 20 years, the $100,000 has grown to $265,330, an increase of $165,330. The increase in years 10 to 20 was $102,440, even more than the initial principal, and a big increase on the rise in the first 10 years of $62,889.

- After 30 years, the balance has reached $432,194 and after 40 years, the original $100,000 has reached $704,000, or seven times the original principal.

If we use 7.5% real for 40 years, which investors from previous generations could have achieved just by buying residential property or a share index fund, $100,000 would be worth $1.8 million.

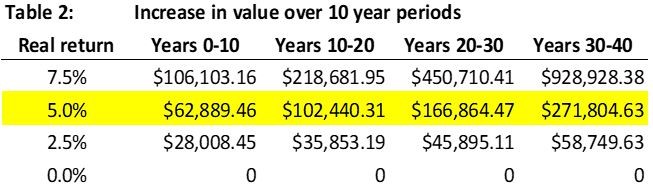

Table 2 shows how quickly the interest on interest dominates the interest on the original $100,000 invested. Consider how much the value of the investments increases in each decade over a 40-year period.

At the heady real return rate of 7.5%, the final decade alone grows by nearly a million dollars.

What investing lessons do these numbers teach us?

Let’s say someone inherits $100,000 at the age of 25 and wants $1 million by the time they reach 65.

- If they can achieve a 7.5% real return, they will have $1.8 million without saving anything else (except paying off their home and covering any tax). If $1 million is sufficient, they could achieve this amount after 32 years.

- If they can earn a 5% real return, after 40 years they would have $700,000. This is still an outstanding result but to reach the $1 million, they will need to sit down with a financial adviser and implement some other wealth strategies.

- If they earn a 2.5% real return, at the end of 40 years, they will have only $268,000. The amount is falling dramatically, reaching only one-quarter of their goal. In order to achieve their goal, they would need to commit to significant extra savings which also may involve working longer.

- If they leave their money in cash or term deposits earning the inflation rate (a circumstance facing a vast number of retirees now), then at best the purchasing power of their $100,000 is retained. It will do very little to finance a comfortable retirement.

With such low interest rates on offer, this is a massive issue for today’s investors. In the past, wealth could be accumulated over time by relying on high compounding returns. That’s why many older ‘average’ income earners live in multi-million-dollar homes.

Low returns require a fundamental rethink. Far more of the retirement nest egg will need to come from savings over a longer period to avoid missing a lifestyle goal.

Conclusion

The concept of compound interest essentially means “interest on the interest” and is one of the most powerful forces of investing. As such, it is a key concept to understand to have a successful long-term wealth strategy.

You don’t need to be wealthy to become a millionaire. You need good financial advice, solid investment performance and time to let the power of compound returns do its thing.

In this ‘save early, save often, save for a long time’ message, the last word goes to Warren Buffett, and it applies for most people, even those of average means.

“I always knew I was going to be rich, so I was never in a hurry.”

Next steps

To find out more about how any of these measures may be of assistance in your individual circumstances, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.