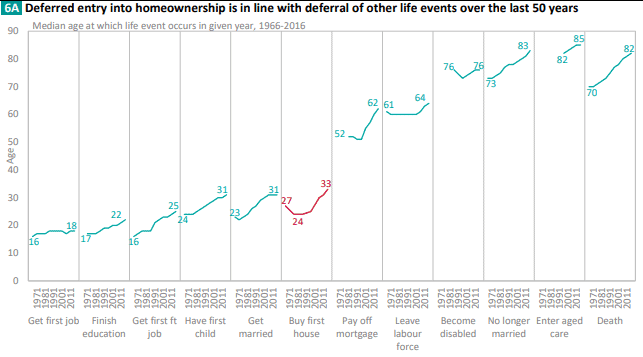

Some interesting research out recently shows how the steady deferral in home ownership over the past 50 years has accompanied delays in all other major life events. Buying a first home has pushed out from 27 years to 33 years of age and paying off the mortgage from 52 to 62.

The research comes courtesy of the ARC Centre of Excellence in Population Ageing Research (CEPAR) which focusses on research in the field of population ageing.

In Australia, the topic of housing occupies many a newspaper column, barbeque conversation and research report. Just over half (or $6.3 trillion) of Australian household wealth is stored in housing, distributed across 10.3 million residential dwellings, which are among the most expensive in the world.

The median age of first buying a house decreased in the 1960s-70s as home ownership became widespread. It has since increased by 9 years from 1981 (from age 24 to 33). But deferral in home ownership accompanies delays in all other major life events over the last half-century, as shown below.

These include a delay in the median age of getting a first job (2 years), finishing education (5 years), having a child (7 years), getting married (8 years), and dying (12 years). The good news is that despite deferring their first home purchase by 9 years, longer living younger generations will still probably enjoy home ownership longer than their parents.

If you have any If questions/thoughts in relation to this article or would like more information, please click here to send us a brief email.

If you have any If questions/thoughts in relation to this article or would like more information, please click here to send us a brief email.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.