The new Labor Party’s contentious policy to deny a cash refund for excess franking credits has sparked a debate about who is rich and who pays tax, with ambiguous data that is confusing most people. Since the announcement only a few weeks ago the Shadow Treasurer Chris Bowen has just announced modifications to the proposals to offer significant carve-outs for pensioners, which will include SMSFs in some cases.

The drums of class warfare seem to be beating loud and clear after Bill Shorten’s announcement which comes on the heels of Labor’s proposal to reform negative gearing, reduce the CGT discount and tax family trusts at a minimum of 30%.

Dividend imputation prevents investors being double taxed, once at the company level and again at the individual level. The franking credits allow individuals to reduce their taxable income by the amount they paid in corporate tax as a shareholder. The Keating Government introduced this policy; however, the Howard Government extended the policy by refunding any franking credits not used to reduce taxable income. Labor is not ending dividend imputation but is rather returning to the imputation system envisaged by Paul Keating.

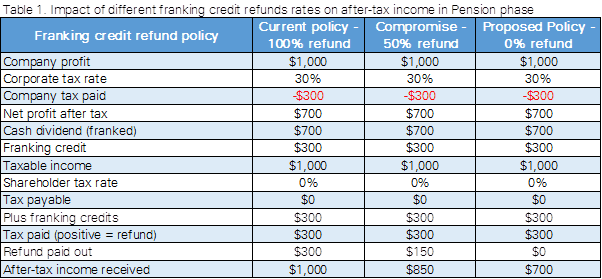

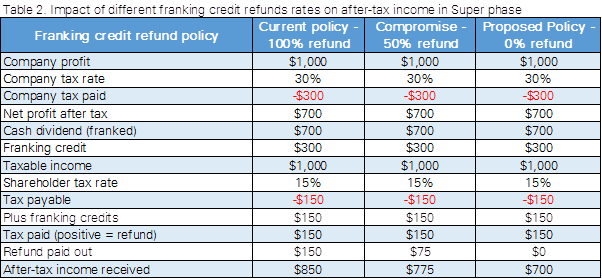

It’s important to understand that the new (or is it old?) policy will have no impact on investors paying a higher tax rate than the company tax rate, since they don’t receive franking credit refunds (see Table 3 below). However, for investors who pay a lower tax rate (this includes superfunds in accumulation and pension phase), the removal of the refund policy renders some or all their franking credits worthless, lowering their after-tax income (see Tables 1 and 2).

Political posturing begins

Unsurprisingly, the Liberal Party is crying murder, with Treasurer Scott Morrison describing the policy as “a brutal and cruel blow for retirees, for pensioners”. This is the Treasurer who introduced balance limits on superannuation accounts and capped non-concessional contributions leading to higher taxes for wealthier investors. Each side of the aisle is employing a healthy amount of spin after the announcement.

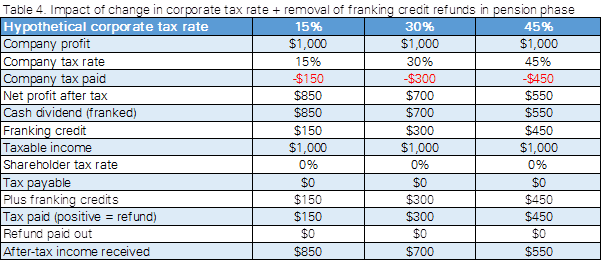

An interesting development will be that if Labor removed refundable franking credits, potential changes in the corporate tax rate will affect the after-tax returns of investors with a lower tax rate than the corporate tax. The corporate tax rate currently has no impact on the after-tax income because higher rates render higher franking credits and vice-versa. However, if investors paying little tax can’t realise their franking credits via a refund, they should benefit from lower tax rates that increase dividends and thus reduce franking credits (i.e. lower corporate tax rates = higher returns for low tax investors, see Table 4).

It’s worth repeating that Labor is not proposing to abolish dividend imputation, but rather the refunding of excess franking credits in certain circumstances.

The examples below show the material impact of the proposed policy on the after-tax income of investors with a lower tax rate holding only shares paying fully-franked dividends.

Impact of removing refunds at different shareholder tax rates

Source: Stanford Brown calculations

The tables assume Australian shares paying fully franked dividends are the only investments held by the relevant shareholder, so for example, there is no other taxable income to reduce by using the franking credit.

One positive from all this is that if franking credit refunds are removed, it may lessen the myopic and concentrated ‘home bias’ that unwittingly causes many Australian investors to take on significant investment risk without generating additional expected returns.

Further diversification of portfolios both across and within global markets is a genuine way of reducing uncertainty in a portfolio, lessens the impact that any single event could have on your portfolio and provides greater consistency of returns.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.