Investors and Market Timing

Anyone who has watched or played sport at a competitive level knows how much emotions can swing during a game. In the course of a couple of hours, the mood can jump from optimism when your team takes an early lead, to frustration as the opposition equalises, to elation as you score again to exasperation and fear as the other team takes control.

It’s the same with investing in volatile markets. A fall of 30% may incite fear of further declines and even an assessment of future plans, pushing some to sell in panic. Then a recovery of 20% drives optimism and FOMO and jumping back in ready for the ongoing rise. This down 30%, up 20% is the actual experience of millions of investors in 2022. Now every analyst in town has a view on whether we’ve seen the bottom.

One of the most famous phrases in investing comes from Sir John Templeton who said,

“Bull markets are born on pessimism, grow on scepticism, mature on optimism and die on euphoria.”

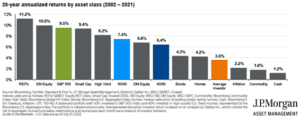

The bull market died after the post-pandemic euphoria at the end of 2021, and the carcass rotted for six months, but then we have seen a strong recovery since mid-June. Anyone trying to guess whether a new bull is galloping should check the latest chart from JP Morgan with 20 years returns across asset classes. It demonstrates that equities (shares) and real estate investment trusts (REITs) were the place to be, so investors are obviously looking for entry points into the various investment markets.

But look at the orange bar. The ‘average investor’ achieved poor returns due to bad timing of entry and exits, buying in euphoria and selling in pessimism.

Source: J.P. Morgan Asset Management’s Guide to the Markets for 3Q 2022.

There are two key behavioural actions which can help avoid these poor investor returns. First, is to remove ourselves from emotional stimulus – turn off financial market news and check our portfolios less frequently. Long-term investors should stop doing anything that provokes a short-term emotional response. Second, we should never make in-the-moment investment decisions, as these are likely to be driven by how we feel at that specific point in time. We should always step away and hold off from making a decision, and reflect on it outside of the hot state we might find ourselves in.

These actions are no panacea; we cannot disconnect ourselves from the impact of emotions on our investment decisions. We know, however, that the negative feelings of stress, anxiety and fear that we experience during volatile markets are likely to encourage some of our worst behaviours and we must do our best to quell them.

Next steps

If you have any questions/thoughts in relation to this article or would like more information, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.