Long-Term Investors, Don’t Let a Recession Faze You

You don’t have to look far to see talk of a looming recession. But while economic downturns can be worrying, research shows share prices generally fall well before a recession begins and recover well before it ends. And average returns have been positive two years after a recession’s onset.

Investors may be tempted to abandon equities and go to cash when there is a heightened risk of recession. However research has shown that share prices incorporate these expectations and generally fall in value well before a recession even begins.

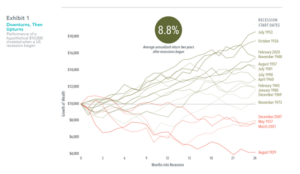

Across the two years that follow a recession’s onset, equities have a history of positive performance. Data covering the past century’s 16 US recessions show that investors tended to be rewarded for sticking with stocks. In 12 of the 16 instances, or 75% of the time, returns on shares were positive two years after a recession began (see Exhibit 1). The average annualized market return for the two years following a recession’s start was 8.8%. Looked at another way, a $10,000 investment at the peak of the business cycle would have grown to $12,145 after two years on average.

Recessions understandably trigger worries over how markets might perform. But a history of positive average performance following a recession can be a comfort for investors wondering whether or not they should move out of stocks.

Markets Don’t Wait for Official Announcements

Some investors may worry about the stock market sinking after a recession is officially announced. But history shows that markets incorporate expectations ahead of the news.

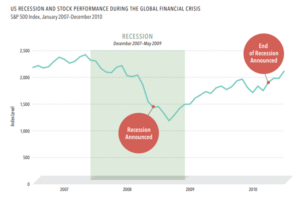

Exhibit 2

The global financial crisis offers a lesson in the forward-looking nature of the stock market. The US recession spanned from December 2007 to May 2009 (shaded area).

But the official “in recession” announcement came in December 2008—a year after the recession had started. By then, stock prices had already dropped more than 40%.

Although the recession ended in May 2009, the announcement came 16 months later, by which time US stocks had rebounded.

Investors who look beyond after-the-fact headlines about markets and the economy and stick to a plan may be better positioned for long-term success.

Exhibit 1 Notes

Past performance is not a guarantee of future results. Data presented in the growth of $10,000 chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

In USD. Performance includes reinvestment of dividends and capital gains. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

Growth of wealth shows the growth of a hypothetical investment of $10,000 in the securities in the Fama/French US Total Market Research Index over the 24 months starting the month after the relevant recession start date. Sample includes 16 recessions as identified by the National Bureau of Economic Research (NBER) from October 1926 to February 2020.

NBER defines recessions as starting at the peak of a business cycle.

GLOSSARY

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French website

Exhibit 2 Notes

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

In US dollars. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Start and end dates of US recessions, along with announcement dates, are from the National Bureau of Economic Research (NBER). nber.org/research/data/us-business-cycle-expansions-and-contractions and nber.org/research/business-cycle-dating/business-cycle-dating-committee-announcements

Stock price decline of more than 40% from December 2007–December 2008 is based on the S&P 500 Index’s price difference between the actual start of the recession in December 2007 and the official “in recession” announcement 12 months later.

We are here to help

Calibre Private Wealth Advisers provides financial leadership and peace of mind for successful professionals, business owners and their families.

We engage our clients in real conversations around their life and then help them use the money they have to get the best Return on Life

If you have any questions/thoughts in relation to this article or have a need for some advice and would like to discuss your particular situation, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.