Stop Worrying About Investments – Just Become a Better Investor

As another financial year begins, we feel compelled to make an important but relatively narrow point about investing.

This is going to sound self-evident or obvious, but the reality is most people don’t understand it.

The point we want to make is this:

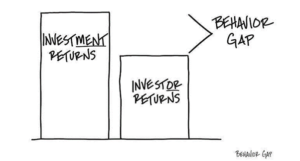

There’s a difference between investment returns and investor returns… and only one of them matters.

Let us explain.

Imagine you open the newspaper, and there’s an ad for a particular investment. The ad says that investment has returned 9% a year for 10 years. That is the investment return: 9% a year for 10 years.

Now, let’s talk about investor returns.

If you put your money into that investment at the beginning of the 10-year period, and you left it there for the whole 10 years—didn’t add any, didn’t take any out, just left it there—what would your return have been? And no, this is not a trick question.

Ding ding ding: That’s right! Your return would have been as advertised: 9% a year for 10 years.

But here’s the catch: Very few people invest that way

Unfortunately, very few people buy long-term investments and hold them for the long term.

That would be silly!

Evidence of poor investor behaviour

The evidence shows that on average, we only hold long-term investments for two to three years, and then we either get disenchanted by short term market movements or distracted by the next hot investment.

Morningstar produces a regular ‘Mind the Gap’ report which compares investor returns with the performance of a range of managed funds and Exchange Traded Funds (ETFs). The latest report published in July 2022 says:

“Our annual study of dollar-weighted returns (also known as investor returns) finds investors earned about 9.3% per year on the average dollar they invested in managed funds and ETFs over the 10 years ended Dec. 31, 2021. This is about 1.7% less than the total returns their fund investments generated over the same period. This shortfall, or gap, stems from poorly timed purchases and sales of investments, which cost investors nearly one sixth the return they would have earned if they had simply bought and held.”

Other research by DALBAR based on 30-year data indicates the average investor in the US S&P500 achieved annual returns of 7.13% while the actual index delivered 10.65%.

Locally, the EY Global Wealth Management Research suggests Australians are more inclined than investors in other countries to exit markets when their portfolio declines. The problem is, they may never get back in.

“Australian clients appear more actively aware of declines in their portfolios than those in other markets, with the vast majority (97%) saying they change investment behaviour due to declines in portfolio value, significantly above the global average of 73% … Continued market stress is amplifying their defensive stance and as well as their appetite for both switching and adding to their portfolio.”

So back to our example, while the investment, in this case, does return 9% per year, we almost never earn that return because we don’t own the investment long enough. We’re too busy jumping in and out of different investments. The return happened… we just weren’t there to get it.

And the only reason for that is our own behaviour.

We think the job of any self-respecting investor is to constantly be searching for the best investment. That makes sense and sounds reasonable enough.

But that well-intentioned behaviour consistently leads many of us to buy investments that have just done well and to sell investments that have recently done poorly.

In other words, the well-intentioned search for the best investment leads us to buy high and sell low, over and over again. And it’s that repeated behaviour that leads to the difference between investment returns and investor returns.

Once you see this, it’s hard to unsee it. And that’s our hope. Our hope is that this will be seared into your brain, and you won’t be able to forget it. Stop searching for the best investment and, instead, focus on being a better investor. You’ll save a lot of money, and a lot of heartache, if you do.

How we help our clients become better investors

We help our clients by building investment solutions that pursue higher expected returns in a systematic way.

- Firstly, we apply stringent academic research from some of the finest investment minds in the world to identify sources and dimensions of higher expected returns.

- We then design portfolios to systematically capture those sources of higher expected returns.

- Finally, we construct, rebalance and maintain portfolios that are low cost, tax efficient and highly diversified whilst avoiding unnecessary turnover and trading costs.

History has shown this to be the best way to protect and grow your wealth, so you have the highest chance of achieving your longer-term goals.

As much as we use evidence and science to construct portfolios, it is patience, discipline and human emotions that will ultimately determine the success of our investment strategies.

Our ongoing counselling helps our clients understand how investment markets operate.

Our coaching around realistic return expectations for different portfolios and a longer-term view of markets, ensures they are better prepared to apply the necessary discipline during inevitable bouts of market volatility.

All this helps our clients adhere to their longer-term investment plans and significantly improve their chances of success.

We are here to help

Calibre Private Wealth Advisers provides financial leadership and peace of mind for successful professionals, business owners and their families.

We engage our clients in real conversations around their life and then help them use the money they have to get the best Return on Life

If you have any questions/thoughts in relation to this article or have a need for some advice and would like to discuss your particular situation, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.