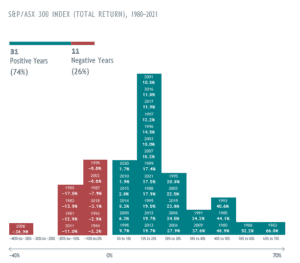

Annual share market returns are unpredictable, but “up “years have occurred much more frequently than “down “years in Australia. That may be reassuring to investors, especially if they find market downturns unsettling.

- The Australian share market posted positive returns in 74% of the calendar years from 1980 through 2021.

- The market gained an annualised average of 11.1% during this period. Yet nearly two thirds of yearly observations were at least 10 percentage points above or below the average.

- Another noteworthy trend: More than 90% of the down years were followed by up years. The most recent example: a 3.1% loss in 2018 followed by a 23.8% gain in 2019.

The share market tends to reward investors who can weather annual ups and downs and stay committed to a long-term plan.

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In AUD. S&P/ASX data copyright 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Next steps

If you have any questions/thoughts in relation to this article or would like more information, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.