This article is written by MCP Group. MCP help us provide tailored debt solutions for our clients and are a well-established member of the handpicked Calibre Professional Network team.

This article is written by MCP Group. MCP help us provide tailored debt solutions for our clients and are a well-established member of the handpicked Calibre Professional Network team.

Global Debt

Recent data collated from the International Monetary Fund (“IMF”) showed that global debt has increased to $226 trillion.

So what does it all mean?

Unpacking The Numbers

Similar to how a bank will look at an individual customer’s capacity to service debt with income, a relatively blunt macro measure is to assess the level of debt as a percentage of a country’s Gross Domestic Product (“GDP”).

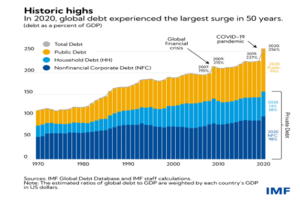

With the world hit by a health crisis in 2020, Governments pulled every lever to buffer economies. However, as the IMF data shows below, debt was already at very high levels prior to COVID-19. The warnings from central regulators like the IMF were already loud and clear that corrective action for both households and Governments would be needed in the future.

For some countries, Government debt is the primary concern, whilst for others (such as Australia) it is the increased level of household debt relative to income that is far more material.

For example, Government or “Public” debt alone has now touched 100% of GDP, which is unprecedented.

One challenge is that the Government and Private sectors will need to manage debt in an environment of rising interest rates. The World Economic Report published late last year, outlined a top list of countries with the highest Debt relative to GDP.

The list is diverse, with many on the list (think Greece) already suffering economic collapse in the recent past whilst others (Singapore, Japan) trade more heavily on the goodwill of their future economic prospects.

What is the relevance of Debt for Countries?

Well, largely it depends on your perspective and believe it or not there is a divergence of views of debt. Most Governments owe the money to their own people (Japan above is a prime example of this) rather than as foreign debt. In this context, the economic impacts can be less immediate. This is especially so in an historically low interest rate environment.

However, as a general rule, when debt increases faster than GDP, that will eventually bring more pressure on an economy to increase taxes or cut spending.

When debt increases faster than GDP, there is more pressure on the economy to increase taxes or cut spending.

What is the relevance of Debt for Australia?

Our Government Debt, whilst spiking, still sits at a comparatively low 45% of GDP and just under $1 Trillion.

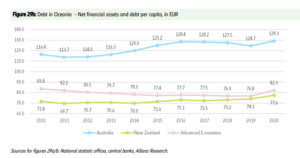

For households, this is where it gets more personal. For example, Australia’s debt to income ratio is the second highest worldwide and reached a high of 129.3% in 2020 which is well above developed economies. See Table below.

Australians are wealthier on paper, as asset growth has outpaced liability growth, which are principally property mortgages. Our liability-to-asset ratio has improved significantly in the last decade, now under 40% from around 50% ten years ago.

Despite this “wealth” based growth, we haven’t had the income growth to keep pace with asset growth. In an accounting sense, the balance sheet is stronger but the Profit & Loss is weak. The risk of this is it opens up vulnerability to asset price changes or a rise in the cost of debt which we are seeing at present. After all, “it’s not what you own that might send you bust but what you owe.”

The rise in debt means that moves in interest rates are now nearly three times as potent compared to 30 years ago. Just a rise in the cash rate to 2.5% will see a near doubling in debt interest payments as a share of household income. Coming at a time of falling real incomes due to cost-of-living pressures this implies a significant hit to household spending power

While many households have built up cash buffers and are ahead on their mortgage payments and the household saving rate remains high, RBA analysis also indicates there is a significant group who would see a sharp rise in their mortgage payments if mortgage rates rose by 2% and most economists and the market expect more than this. Only time will tell how significant this becomes.

Final Thoughts

There is not a simple set of commentary that can identify clearly both what the quantum of the problem is and any corrective actions. Without sounding like “motherhood” statements, perhaps some thoughts to consider:

Economies need to balance the need for economic stimulus with an understanding of impact on long term economic growth, inflation and gearing levels.

Economies need to stress test their ability to take on and service debt, if their traditional income sources are challenged in the longer term. Think climate change and commodities as an example.

Maybe we need to consider building the financial literacy of the population; debt looks much more attractive to people without financial education – e.g., property schemes or similar that might encourage asset buying in peak markets.

Ultimately it may mean that we all need to water down our expectations of what we are entitled to, and work with what is sustainable in the long term.

Next steps

If you have any questions/thoughts in relation to this article or would like more information, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.