While every downturn is different, history suggests that those investors who keep their nerve, stick to their agreed financial plan, and maintain focus on their chosen horizon at these times tend to do significantly better than those who sell assets that have already fallen in price. This is a time for calm reflection and there are some key lessons that can help investors reach their financial goals despite the occasional periods of volatility.

Key takeaways

- Reacting to down markets is a good way to derail progress made toward reaching your financial goals.

- Over the past century, US shares have averaged positive returns over one year, three year, and five year periods following a steep decline.

- One of the best ways to avoid succumbing to emotion at the expense of your portfolio is to partner with an adviser and make a plan.

Investors can always expect uncertainty. While volatile periods like the one we’re experiencing now can be intense, investors who learn to embrace uncertainty may often triumph in the long run. Reacting to down markets is a good way to derail progress made toward reaching your financial goals.

Here are the three lessons to keep in mind during periods of volatility that can help you stick to your well-built plan. And if you don’t have a plan, there’s a suggestion for that too.

- A recession is not a reason to sell

Are we headed into a recession? A century of economic cycles teaches us we may well be in one before economists make that call.

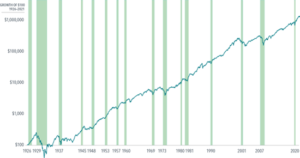

But one of the best predictors of the economy is the share market itself. Markets tend to fall in advance of recessions and start climbing earlier than the economy does. As the chart below shows, returns have often been positive while in a recession.

Source: Dimensional Fund Advisors

In US dollars. Recessions shaded in green. Share returns represented by Fama/French Total US Market Research Index, provided by Ken French and available at mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

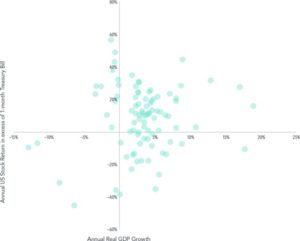

All the dots in the upper left quadrant in the chart below are years where the US economy contracted but US shares still outperformed less-risky Treasury bills. It’s a great illustration of the forward-looking nature of markets. If you’re worried, other investors are too, and that uncertainty is reflected in share prices.

Source: Dimensional Fund Advisors

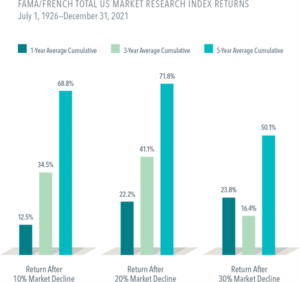

Whether accompanied by recessions or not, market downturns can be unsettling. But over the past century, US shares have averaged positive returns over one-year, three-year, and five-year periods following a steep decline.

A year after the S&P 500 crossed into bear market territory (a 20% fall from the market’s previous peak), it rebounded by about 20% on average. And after five years, the S&P 500 averaged returns over 70%.1

Source: Dimensional Fund Advisors

We believe that staying invested puts you in the best position to capture the recovery. If you take risk out of your portfolio, it should be a strategic, not tactical, choice. We believe the only good reason to sell out of a share portfolio now—so long as it’s diversified and low-cost—is because you learned something about your risk tolerance or your investment goals have changed.

- Time the market at your peril

When shares have declined, it might be tempting to sell to stem further losses. You might think, “I’ll sit out until things get a bit better.” But by the time markets are less volatile, you’ll have often missed part of the recovery. Yes, it stings to watch your portfolio shrink, but imagine how you’ll feel when it’s stuck while the market rebounds.

Big return days are hard to predict, and you really don’t want to miss them. If you invested $1,000 in the S&P 500 continuously from the beginning of 1990 through the end of 2020, you would have $20,451. If you missed the single best day, you’d only have $18,329—and only $12,917 if you missed the best five days.2

History shows the share market tends to rebound quickly. The same can’t be said for individual shares or even entire sectors. (How many railroad shares do you own?) So, while investing means taking on some risk for expected reward, investors should mitigate risks where they can. Diversification is a top risk mitigation tool, along with investing in fixed income and having a financial plan.

3. It may be a good time to reassess your portfolio and your plan

We saw many fads crop up through the pandemic, from baking to puppy adoption. Did you experiment with any of the pandemic investment fads—FAANGs or meme shares or dogecoin? If so, it may be time to put those fads in the rearview.

Do you know the names of all the shares you own? If so, then you probably own too few. How much of your portfolio sits outside Australia? If you only invest in Australian shares, you’re missing more than 98% of the global investment market opportunity set. A market-cap-weighted global portfolio is a better starting point than chasing segments of the market that have outperformed in the past few years.

And if you want to outperform the market, allow decades of academic research to light the way. Portfolios focused on small caps, value shares, and more profitable companies have had higher returns over the long run. The portfolios we recommend to our clients are typically invested across more than 10,000 global equities in over 40 countries.

An enduring adviser relationship can also help.

Beyond a well-designed portfolio, one of the best ways to deal with volatile markets and disappointing returns is to have planned for them. A financial adviser can help you develop a plan that bakes in the chances you’ll experience some market lows. And they can help you find the confidence to weather the current storm and get to the other side.

A sound approach to investing—through a plan, a well-designed portfolio, and the guidance of a professional adviser—is the ultimate self-care during these rough markets. Your future self will thank you.

- S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct

- Past performance, including hypothetical performance, is no guarantee of future

Growth of $1,000 is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The analysis is for illustrative purposes only and is not indicative of any investment. S&P data © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment.

Next steps

If you have any questions/thoughts in relation to this article or would like more information, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.