Whilst global and Australian shares had a nice bounce from their late October lows – they have since fallen back to their lows as the worries about US rates, bond yields, global trade, tech stocks etc., have morphed into broader concerns about global growth and profits. Fears of a credit crunch and falling home prices are probably not helping Australian shares either, which have very recently dipped below their October low.

Higher market volatility is quite normal in the later stages of an economic cycle.

This article will put volatility in context relative to historic trends, and then outline a few things to keep in mind when the market gets choppy.

“A smooth sea never made a skilled sailor”

A market without volatility would be unnatural, like an ocean without waves. The free market, like the open ocean, is constantly churning. For some investors, market moving waves can be exciting, providing a buying opportunity for mispriced securities. But for most investors who focus on their long-term financial goals, the waves in the market can feel violent and threatening.

While all volatility feels uncomfortable in the near term, the important question for all long-term investors is how to respond to it.

Grab an oar! Let’s put all this into some perspective:

Long-term investors who have sought and obtained proper financial advice should think of themselves as a cruise liner. Their diversified portfolio was built to feel steady in rough seas. Here are a few things to consider:

1. Remember that volatility is normal (even though it occasionally makes us feel seasick).

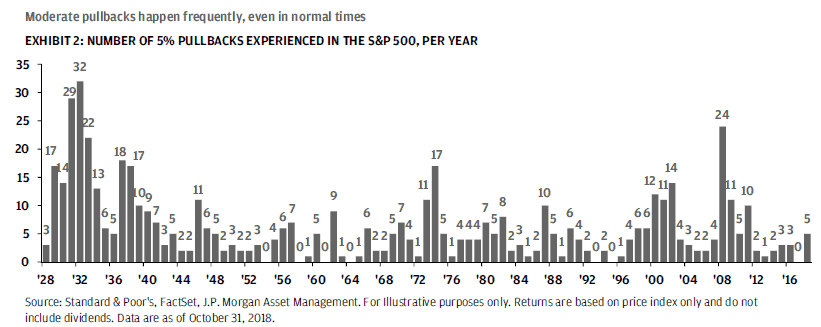

Volatility in the market is normal and feeling uneasy about a lower portfolio value is normal too. Illustrating how often we experience moderate pullbacks is simple enough— the chart below shows the number of 5% pullbacks experienced each year in the US share market over the past 90 years.

This shows that even in years with outstanding equity returns there were rolling waves of volatility in the market. What we cannot show in a graph is the seasickness some investors at times feel while riding these waves to a lower portfolio value.

Historical analysis shows that pullbacks of 5% have occurred about once a quarter, and pullbacks of 10% are likely to occur once per year. Large pullbacks greater than 20% tend to occur just once per market cycle.

2. Do not jump ship at the bottom

Markets have a long-term history of rebounding after bouts of volatility. Focusing on the long-term trends of the market rather than the short-term gyrations should give investors the confidence to ride the waves of volatility. When examining historic share market data, we see a trend of rebounds following equity market pullbacks. That means that investors who jump ship after a big wave may break the cardinal rule of investing by “selling low.”

To help illustrate this point the chart on the next page shows a comparison of an investment in global shares and term deposits since 2002 (with an initial investment $100,000). If you had remained invested in global shares after the Lehman Brothers collapse in 2008 your portfolio would have grown to $283,000 compared to $142,000 if you had moved your money into a term deposit.

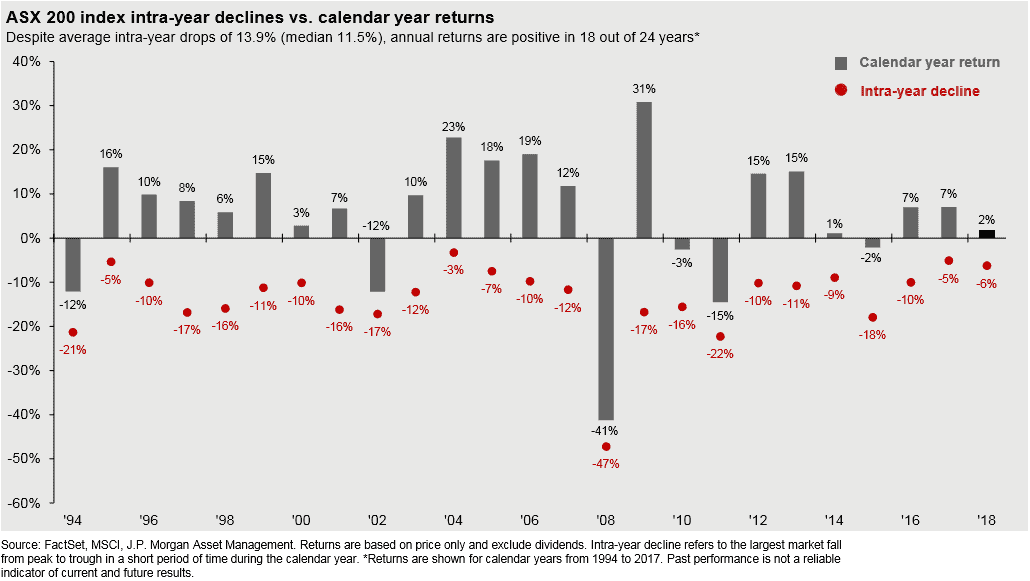

The chart below shows the largest intra-year decline and the calendar year return for the Aust share market every year since 1994. Despite an average drop of 13.9%, the market ended the year higher than it began it 75% of the time. That is why it is important for investors to ride the wave of volatility through its full cycle.

Frequent pullbacks in the market can be unsettling, and can encourage market timing, but investors should not jump ship. Sticking to your predetermined strategy is especially important when there is market volatility, because the best and the worst days of the market tend to cluster together. If you are lucky enough to miss the bad days, you will also likely miss the best days.

3. Focus on the destination.

While volatility can cause major deviations in the near term for equity markets, investors should focus on their destination.

Investors with long-term goals who are, with the assistance of an experienced adviser, able to shift their focus to the long-term return potential of growth investments have the luxury of realizing infrequent negative equity market returns.

The final chart below shows how, over the past 20 years (GFC included), an investment in Australian shares has provided significantly more growth than an investment in cash.

Conclusion

Most clients need some exposure to more volatile growth assets to reach their long-term lifetime financial goals and staying invested throughout that time horizon can at times be their biggest challenge. Though it is impossible to predict the future, further market volatility in the coming years is a safe bet. Just as the last 20 years have favoured the well diversified investor, we expect the next 20 will do the same.

The reward for taking a long-term time horizon is capturing the compounding effect that is forgone by others who quit before you.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.