The Importance of Succession Planning for SMSFs

Article written by Super Concepts (a leading SMSF administration provider)

Succession planning in an SMSF should be an important consideration for all SMSF members. With the right planning, a smooth succession can be achieved with administrative ease, minimal compliance hassles, tax effectiveness and certainty upon the death of a member.

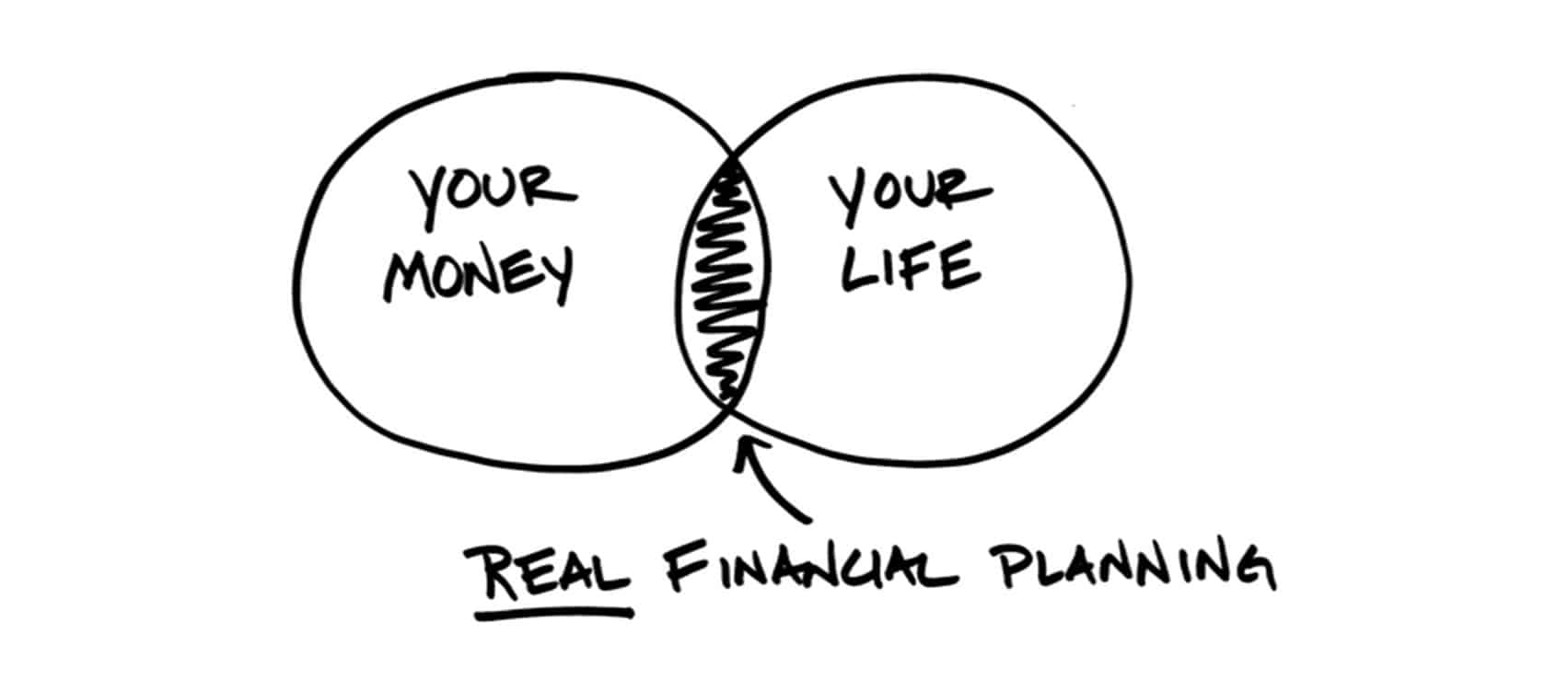

But what is succession planning? How does it differ from estate planning?

Succession planning is about control. Good succession planning ensures the right assets go to the right person at the right time. But what is the difference between succession planning and estate planning?

Succession planning is about control and estate planning is about distribution.

Estate planning is, in essence, a sub-set of succession planning.

Succession planning establishes who takes over driving when a trustee can’t anymore.

Estate planning establishes who gets the assets and how they get them.

Super laws have changed markedly over the last 13 years or so, with Simpler Super in 2007 and the more recent changes in 2017, have made super more about the current member than a wealth transfer vehicle.

This also, however, makes succession planning more important than ever to ensure administrative ease, certainty, compliance (such as Transfer Balance Accounts, reporting obligations, etc.) and importantly all this occurring in the most tax effective manner possible.

Trustee of the fund after death

The first things to note is when a member dies, they also cease to be a trustee (individual or director of a corporate trustee).

This may mean the fund fails to satisfy the definition of an SMSF.

But the super laws – the SIS Act – gives us 6 months to restructure the fund, so it again satisfies the definition of an SMSF.

With a simple fund, comprising 2 members, the surviving spouse may look to appoint the Legal Personal Representative (LPR) – the executor of the deceased – as the replacement trustee.

This may be themselves, or often it may be adult children who can assist with the running of the fund.

Does this mean the fund will again satisfy the definition of an SMSF? Mum continuing as trustee in her own right, and, say, Mum and her two adult children as LPR for Dad?

Yes. The fund will satisfy the definition of an SMSF if Mum and the Executors of Dad’s estate are trustees of the fund, but only for a period of 6 months after Dad’s benefit commences to be paid.

After that time, the trusteeship will need to be permanently restructured.

Super is not an estate asset

It’s important to understand that super is not an estate asset so the LPR being appointed as trustee in place of the deceased member is not an automatic appointment.

Super exists in its own world. Your Executor is only appointed trustee if the fund’s governing rules – the trust deed – allows for it.

In many cases there may be no issue with this but in blended family situations it can be a major issue. There is much case law regarding control of SMSFs such as Ioppolo & Hesford v Conti & Anor [2013]. 4 daughters from the first marriage challenged the payment of a death benefit and wanted to be appointed co-trustee of the fund as Executors of the deceased. Unfortunately for them the fund’s Trust Deed did not expressly allow for this.

Remember succession planning is about who controls a fund when the trustee cannot.

The importance of the fund’s Trust Deed

One cannot underestimate the importance of the fund’s trust deed as this mandates what a fund can and cannot do.

The fund’s trust deed does not only outline if the Executor can be appointed in the role of a deceased trustee; it also identifies who has the power to appoint a new trustee upon a member’s death.

This last point is important, as single member funds with individual trustees involve a little more thought than funds with corporate trustees.

Why is that?

One issue is the requirement for asset to be registered in the names of the individual trustees. This can be a time-consuming process so; you only want to do it once!

And of equal importance, to deciding who will be individual co-trustee after one has passed away, is clarity around whether a majority or other voting threshold is required for member decisions.

Perhaps the LPR and the existing trustee disagree on who is going to be appointed as new trustee and/or member?

This becomes even more crucial with the recent introduction of 6 member funds – if another generation comes into the fund, who has control?

Is it by member balance? If the LPR represents a deceased member, who had the larger balance in the fund, does that mean the LPR has more decision-making power than the existing member?

Does the LPR have a casting vote?

Notwithstanding that fact, we would always recommend establishing a corporate trustee even if it involves a restructure while both members are alive.

Administration, especially when it comes to succession planning, is much easier and cleaner.

One also needs to be careful with shares in the Corporate Trustee. On the death of a Director/Shareholder, who inherits the shares? Shareholders can remove Directors, so the deceased’s Will could say the LPR inherits the deceased member’s shareholding in the Corporate Trustee.

SMSF trustees need to be careful as to how this is all structured.

Binding Death Benefit Nominations

A Binding Death Nomination (BDBN) is a direction from Member to Trustee to pay their benefit a certain way on death.

It is absolute – the Trustee must follow the member’s direction. However, it must be valid – otherwise it’s invalid.

Most large super funds only provide 3-year lapsing BDBNs. However, an SMSF can have a non-lapsing BDBN if the Trust Deed allows.

SMSFs can have a cascading BDBN which directs the Trustee to pay the benefit to a subsequent beneficiary if the primary beneficiary passes away. But again, the governing rules must allow for this.

BDBNs are a part of the succession planning solution, but who controls the Fund is of critical importance!

Why is control of critical importance?

Once again, case law shows us what can go wrong. In Wooster v Morris [2013] VSC 594 the deceased completed a BDBN in favour of 2 daughters from a first marriage. The surviving individual Trustee (second Wife) disregarded the BDBN which a court later found to be valid.

But the plaintiffs had to wait three and a half years to get their money!

A well-constructed BDBN, along with a corporate trustee, Trust deed and other documentation, that ensures the right people are in control of the fund, are cornerstones of effective succession planning.

Reversionary pensions

This is another piece of the puzzle. A reversionary pension is one where documentation shows the income stream is to ‘revert’ to a subsequent beneficiary (or beneficiaries) on the demise of the primary pensioner.

This means the pension does not cease on the death of the primary pensioner – it continues seamlessly and can be paid to multiple beneficiaries, such as minor children.

The ability of the fund to pay a reversionary pension can be ‘hard-wired’ into the Trust Deed. This can be beneficial on several levels such as making a non-reversionary pension reversionary without having to stop and restart (which may impact Centrelink or other grandfathering provisions).

Reversionary pensions provide certainty as to who gets your death benefit.

Combined with a BDBN, strategies can be implemented that stream various benefits to different beneficiaries to maximise planning outcomes.

This last point is important; each pension account is a separate superannuation interest, whilst an accumulation account is only ever one superannuation interest. The combination of reversionary pension and BDBN can mean the right person receives the right benefit with minimal fuss and, importantly, minimal tax.

BDBN versus Reversionary Pension – which one takes precedent?

Whilst the two should be used to complement each other, we are often asked which takes precedent? If a client has a reversionary pension that stipulates a spouse is to receive the benefit, but a BDBN states the same benefit is to go to the deceased’s estate, which one wins?

Remember a BDBN is a direction from the Member to the Trustee instructing how the Trustee should pay the Member’s benefit if they die. A BDBN is binding on the Trustee of the Fund.

However, a reversionary pension does not cease on death – it seamlessly continues to the reversionary pension recipient. A reversionary pension is akin to a contractual obligation.

Therefore, in most instances, a reversionary pension trumps a BDBN however it often depends on the Fund’s Trust Deed and other documentation.

Conclusion

Effective SMSF succession planning involves the following:

- A well drafted and regularly reviewed Trust Deed. The trust deed sets out the governing rules of your fund – what your SMSF can and cannot do. It is the fund’s most important legal document.

- A clear nomination as to whom death benefits of the member shall be paid. This should be supported with documentation such as reversionary pension documents and a BDBN. It may be beneficial to have these elements hard-wired into the SMSF’s Trust Deed.

- Appropriate directions via the deed, Company Constitution and other contemporaneous documentation as to who controls the trustee of the SMSF in the event of an existing member passing away.

An SMSF only forms part of the member’s overall succession planning. It is important that Wills, Enduring Powers of Attorney and any other estate planning documentation (such as testamentary trusts) align ensuring the right people, at the right time, receive the right benefit.

Succession and Estate Planning can be complex so professional advice may be a prudent step. Our experienced team at Calibre Private Wealth Advisers can help you and your intended beneficiaries address any gaps in your current arrangements and map out an inheritance framework that you can be confident will meet your needs in the future

Next steps

To find out more about how any of these measures may be of assistance in your individual circumstances, please contact Gordon Thoms or David Conte at Calibre Private Wealth Advisers on ph. (03) 9824 2777 or email us here.

The information contained in this article is of a general nature only and may not take into account your particular objectives, financial situation or needs. Accordingly, the information should not be used, relied upon or treated as a substitute for personal financial advice. While all care has been taken in the preparation of this article, no warranty is given in respect of the information provided and accordingly, neither Calibre Private Wealth Advisers, its employees or agents shall be liable for any loss (howsoever arising) with respect to decisions or actions taken as a result of you acting upon such information.

This advice may not be suitable to you because it contains general advice that has not been tailored to your personal circumstances. Please seek personal financial and tax/or legal advice prior to acting on this information. Before acquiring a financial product a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product. The material contained in this document is based on information received in good faith from sources within the market, and on our understanding of legislation and Government press releases at the date of publication, which are believed to be reliable and accurate. Opinions constitute our judgment at the time of issue and are subject to change. Neither, the Licensee or any of the Oreana Group of companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. Gordon Thoms and David Conte of Calibre Private Wealth Advisers are Authorised Representatives of Oreana Financial Services Limited ABN 91 607 515 122, an Australian Financial Services Licensee, Registered office at Level 7, 484 St Kilda Road, Melbourne, VIC 3004. This site is designed for Australian residents only. Nothing on this website is an offer or a solicitation of an offer to acquire any products or services, by any person or entity outside of Australia.